Swishfund

Case details

Swishfund is a fintech company that provides fast and accessible business financing to Small and Medium-sized Enterprises (SMEs). Swishfund is operating in a fast-paced market, with many competitors, the tech layer of their business processes therefore needs to be solid, quick and user friendly.

Client:

Swishfund

Services:

Custom API, Clientportal, API integrations, Microservices

Date:

2018 – Ongoing

Engineering a Seamless Digital Core in a Complex Fintech Ecosystem

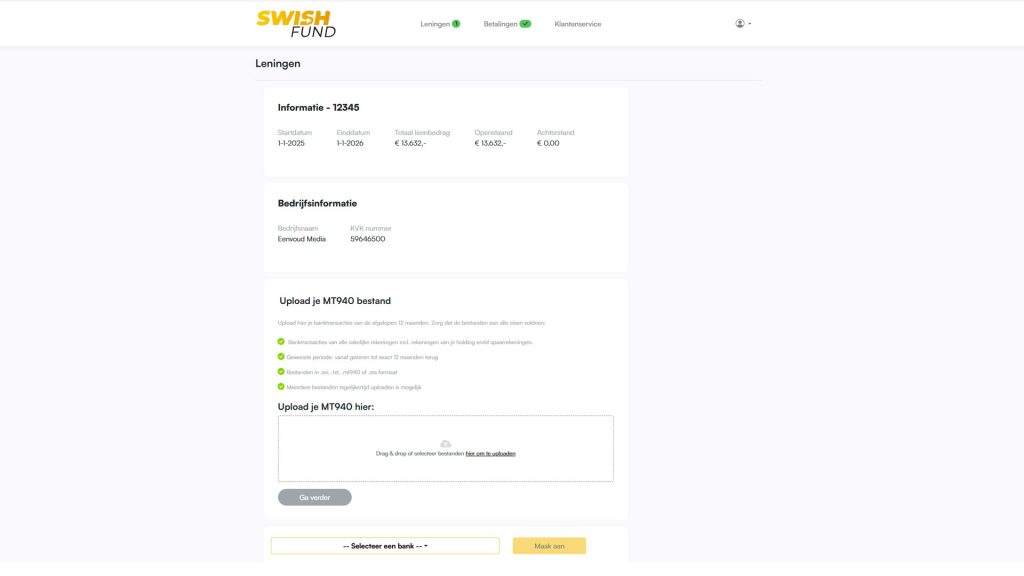

Swishfund required a fast and user-friendly digital core to compete in the fintech market. The primary challenge was developing their loan application process, demanding seamless integration with multiple third-party APIs for data validation and a bespoke API for data collection, all wrapped in a smooth user experience.

This challenge evolved with Swishfund’s pursuit of innovation, requiring us to integrate with new and emerging financial platforms. This often meant navigating technologies in their early development stages, turning each project into an exploratory journey to keep Swishfund ahead of its competitors.

More information about this project?

Please don’t hesitate to contact us!

An Agile Partnership Delivering Evolving Integrations

We began by developing Swishfund’s core website, focusing on the complex loan application process. Our solution established a robust architecture that flawlessly integrated third-party validation APIs and a bespoke data collection API, ensuring a frictionless user experience. Building on this success, our partnership has evolved. We have since delivered a suite of microservices, connecting Swishfund with key platforms like Rabobank Direct Connect, Plaid, and Nordigen. This agile, exploratory approach to navigating new technologies consistently yields successful outcomes, keeping Swishfund at the market’s forefront.