Metics: A fintech startup

Case details

Metics is a fintech company that is passionate about revolutionizing financial planning and decision making. Their mission is to empower businesses, entrepreneurs and finance professionals to achieve success through innovative, user-friendly scenario planning software.

Client:

Metics

Services:

Consultancy, app development, data visualisation

Date:

220-2025

Can we create a platform that reduces errors, time and gives clear insights in financial modelling?

Financial planning is often fragmented across dozens of Excel spreadsheets, riddled with manual inputs, inconsistent formulas, and hard-to-track assumptions. This scattergun approach not only wastes significant time but also heightens the risk of costly errors.

Nearly 90% of spreadsheets contain errors, and a single flawed formula or misplaced decimal can distort entire forecasts, leading to major strategic missteps. Formula inconsistencies—such as referencing the wrong cells or using mismatched logic across rows—are common and can cascade into unreliable outputs and diminished credibility.

Moreover, manual data entry multiplies the chances of human mistakes. Even minor keystroke errors or mis-formatting (e.g., mixing text with numbers) can throw off financial statements or ratios . The absence of version control and audit trails further exacerbates the problem—most spreadsheets lack built-in change tracking, making it difficult to determine who made changes, when, and why.

As businesses scale, spreadsheets struggle to keep up. They tend to slow down or crash with large datasets, and merging data from multiple sources becomes a cumbersome, error-prone task.

More information about this project?

Please don’t hesitate to contact us!

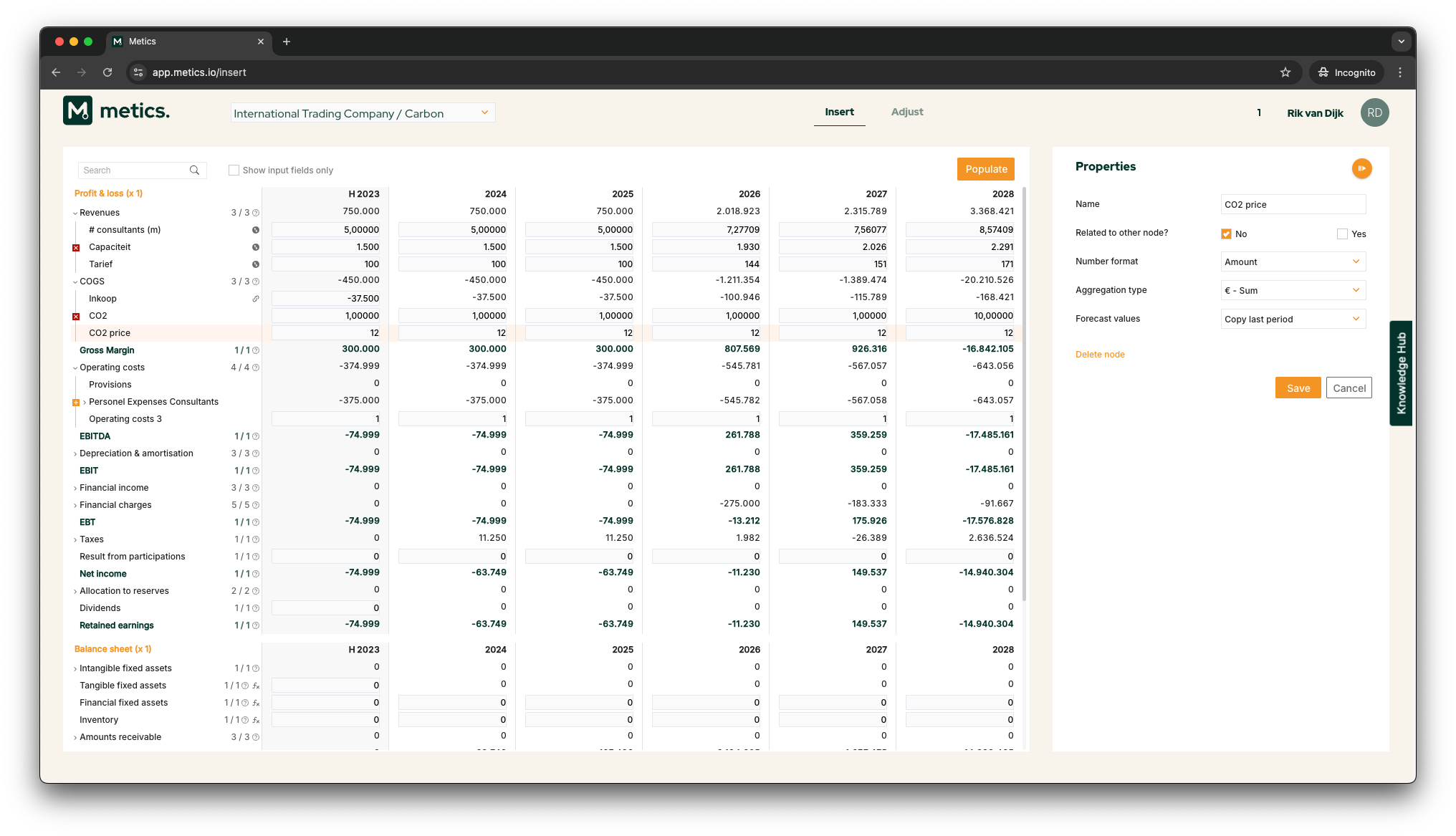

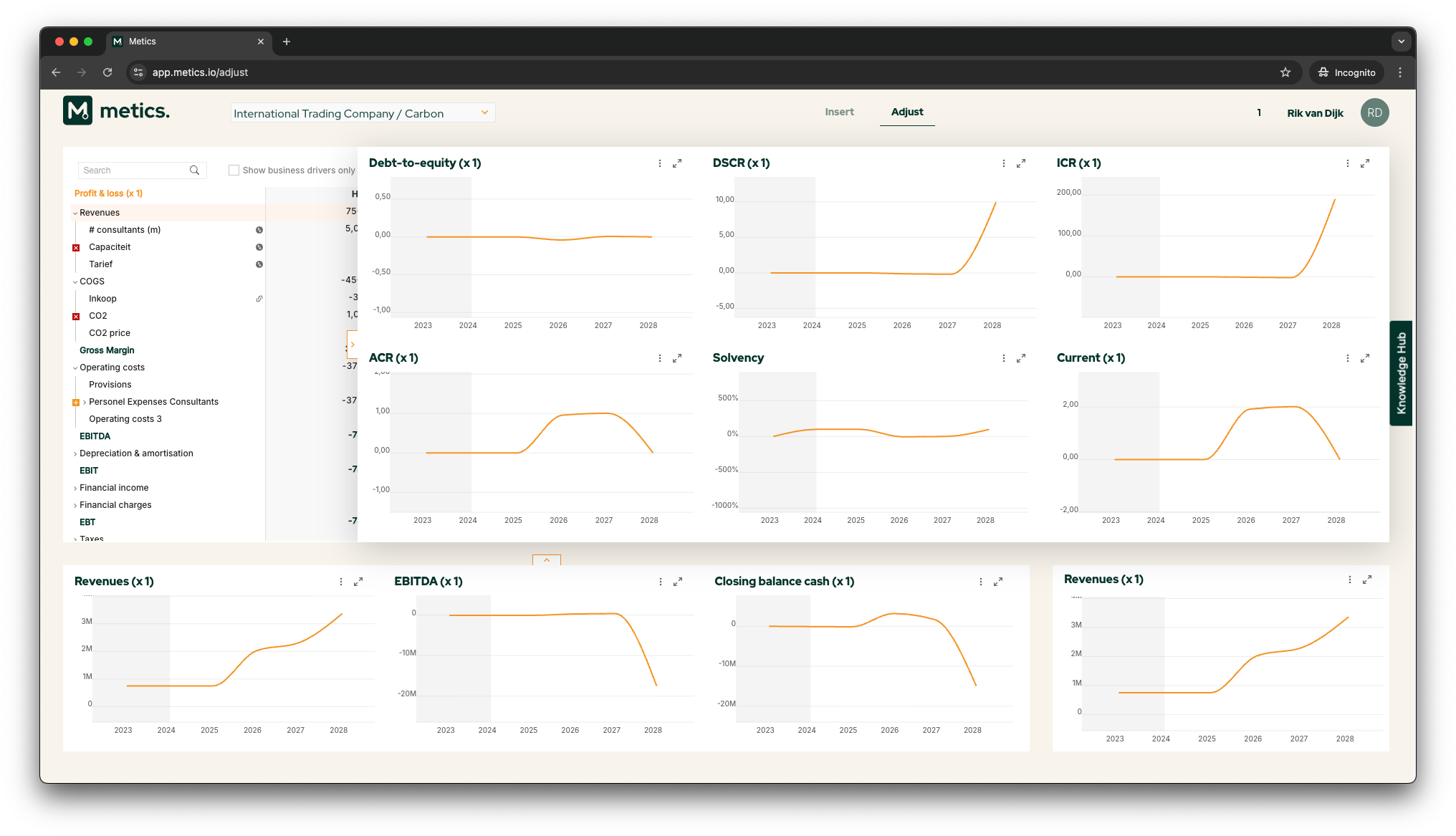

A smart, intuitive platform for building balance sheets, profit & loss forecasts, and financial scenarios, all in one place.

Together with the Metics team, Eenvoud built a clean and powerful web application that makes business planning faster, more reliable, and even enjoyable. Key components of the software:

- Designing an interface that feels familiar to Excel users, but far less error-prone

- Creating dynamic balance sheet and P&L models that update in real time

- Enabling multi-year financial forecasting with scenario comparison

- Building logic that understands how different metrics interact – no formulas required

- Making it easy to collaborate and share plans across teams and advisors

- Ensuring everything is stored securely in the cloud, with full version control

The team worked closely with financial experts to model the platform’s core logic, making sure it’s robust enough for CFOs, but clear enough for founders and managers.